There are many aspects of a business’s ability to thrive that are predictable. Just as in life, businesses can be negatively impacted by things that can’t be predicted and even preventive. There are legal documents like Buy-Sell Agreements, and insurance products like Key Man Insurance, and technology protocols like continuity and redundancy services. The 831(b) is little known tool that businesses can use to ‘self-insure’ with pre-tax dollars. Much like the 401(k) tax code allows an employer to set aside tax-deferred dollars for retirement, the 831(b) tax code allows a business to set aside tax-deferred dollars for underinsured and/or uninsured risks. The similarities are clear and business owners should consider the risk mitigation advantages, before the next pandemic, natural disaster, or global supply crisis. Ed Bryan of SRA 831(b) Admin joins Karen to discuss this critical, and little known, element of the tax codes that benefit businesses, large and small.

Ed Bryan has more than 20 years of sales and operations management experience with a consistent history of leading high-performing sales teams and operational excellence. As Director of Business Development, Ed leads the SRA team in partnering with clients and valued advisors to provide next-level strategies to business owners. http://831b.com

Karen Rands advises angel investors on best practices for screening deals, conducting due diligence & creating a syndication to fully fund the company’s round, when selecting private companies to invest in for large upside potential. Entrepreneur business owners benefit from Karen’s insights for growth strategies and access to capital through direct public offerings & investor syndication.

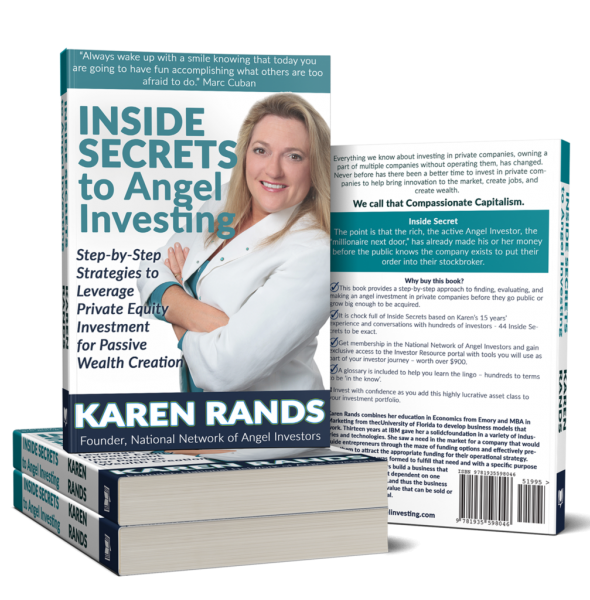

Karen Rands, is the leader of the Compassionate Capitalist Movement and author of the best selling financial investment primer: Inside Secrets to Angel Investing: Step-by-Step Strategies to Leverage Private Equity Investment for Passive Wealth Creation.

Did you know that the ‘idea of’ and the ‘how to’ create wealth as accredited angel investors by investing in entrepreneurs and owning a piece of multiple private companies was a secret for non-millionaires for over 90 years. Karen is an authority on creating wealth through investing and building successful businesses that can scale and exit rich. This podcast is the infomercial for the idea of angel / crowdfund investors as Compassionate Capitalists.

The Compassionate Capitalist Wealth Maximizer System is now available for those investors that want to learn how to invest in entrepreneurs as an asset class like real estate or the stock market. Visit http://Kugarand.com to get your free gift: 12 Inside Secrets to Innovation and Wealth and join the email wait list for the next Free Intro – Wealth Mastery Immersion Challenge

Already investing? Learn how to hire Kugarand Capital Holdings to identify the red flags of deal before you invest, or find out hwo to help syndicate your capital raise.

Other Links: Book, Social Media, Other Podcast Players, Youtube Channel

Visit https://bit.ly/linkCCS