Karen Rands provides context, prior to the replay of her popular podcast on transparency and disclosure between entrepreneurs and investors, for the fraud perpetrated by Elizabeth Holmes, Founder and CEO of Theranos, a company that sought to develop and manufacture a medical device that could identify, monitor, and deliver therapeutics for disease detected through a prick of blood. Introductory comments set the stage for lessons to be learned by all investors.

Elizabeth Holmes had all the characteristics of the ideal startup founder:

- visionary capable of big noble ideas

- intensely competitive

- internally motivated -strong drive and determination

- highly intelligent

- charismatic Except one: commitment to truth & transparency

Yet, she had the fatal flaw that often comes along with these other characteristics, which can hide underneath the surface only to reveal itself when faced with undeniable defeat:

+ total inability to accept and admit failure, due to a fragile ego and innate since of entitlement to succeed at any cost, and therefor not learn from it.

This case is also an example of the weight and validity that investors will place on the tacit endorsement of an early prominent investor, who may not be able themselves to identify the red flags and believe that with enough money a deal can be fixed. Their own ego won’t let them admit they made a bad investment decision so they continue to invest good money after bad, with a wish and a prayer it will work out. In some cases, it does. In the case of Elizabeth Holmes and Theranos, and the $945M invested, it did not.

Article on the history and case of Theranos: https://www.businessinsider.com/theranos-founder-ceo-elizabeth-holmes-life-story-bio-2018-4

Elizabeth Holmes Wikipedia: https://en.wikipedia.org/wiki/Elizabeth_Holmes

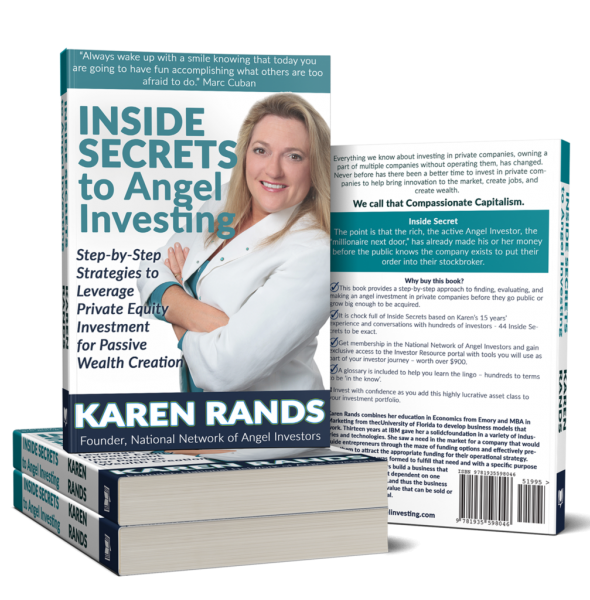

Karen Rands, is the leader of the Compassionate Capitalist Movement and author of the best selling financial investment primer: Inside Secrets to Angel Investing: Step-by-Step Strategies to Leverage Private Equity Investment for Passive Wealth Creation.

Did you know that the ‘idea of’ and the ‘how to’ create wealth as accredited angel investors by investing in entrepreneurs and owning a piece of multiple private companies was a secret for non-millionaires for over 90 years. Karen is an authority on creating wealth through investing and building successful businesses that can scale and exit rich. This podcast is the infomercial for the idea of angel / crowdfund investors as Compassionate Capitalists.

The Compassionate Capitalist Wealth Maximizer System is now available for those investors that want to learn how to invest in entrepreneurs as an asset class like real estate or the stock market. Visit http://Kugarand.com to get your free gift: 12 Inside Secrets to Innovation and Wealth and join the email wait list for the next Free Intro – Wealth Mastery Immersion Challenge

Already investing? Learn how to hire Kugarand Capital Holdings to identify the red flags of deal before you invest, or find out how to help syndicate your capital raise.

Register at http:DoTheDeal.org

Other Links: Book, Social Media, Other Podcast Players, Youtube Channel

Visit https://bit.ly/linkCCS